Introduction

Credit cards are useful tools for shopping, emergencies, or earning rewards. But if you don’t pay off what you owe each month, you’ll face credit card interest the extra fee for borrowing money. Understanding how credit card interest works is key to saving money and avoiding debt. This guide is for beginners people new to credit cards or anyone who wants to manage their finances better. We’ll cover credit card APR explained, how interest is calculated, when it’s charged, and how to avoid it.

Let’s get started the guide:

What Is Credit Card Interest?

Credit card interest is the cost you pay when you borrow money using your card. If you buy something and don’t pay the full amount by the due date, the credit card company charges interest on what’s left. It’s like a fee for delaying payment.

For example, imagine you buy a $100 pair of shoes with your card. If you pay the full $100 by the due date, you owe nothing extra. But if you only pay $50, the remaining $50 gets interest added to it. Depending on your rate, you might owe $51 or more the next month.

Credit cards companies charge interest to make money when you borrow. If you clear your balance every month, you can use the card without paying interest. But if you keep a balance, interest starts piling up. This guide will show you how to keep that from happening.

Knowing APR (Annual Percentage Rate)

APR means Annual Percentage Rate. It’s the yearly cost of borrowing money on your credit card, shown as a percentage. For example, a 20% APR means you’d pay about 20% of your balance in interest over a year. But don’t worry it’s not charged all at once; it’s spread out daily or monthly.

Credit cards have different APRs depending on how you use them. Here’s a simple table to explain:

| APR Type | What It Applies To | Notes |

|---|---|---|

| Purchase APR | Regular buys (clothes, food, etc.) | The standard rate for most spending. |

| Cash Advance APR | Cash from ATMs | Higher rate; interest starts right away. |

| Balance Transfer APR | Moving debt from another card | Might have a special rate or fee. |

| Penalty APR | Late payments or rule breaks | Much higher; a punishment rate. |

| Introductory APR | New cards or promotions | Often 0% for a short time (6–18 months). |

Your APR depends on your card and how you use it. Credit card APR explained: It’s your borrowing cost, and knowing the types helps you avoid surprises.

How Credit Card Interest Is Calculated

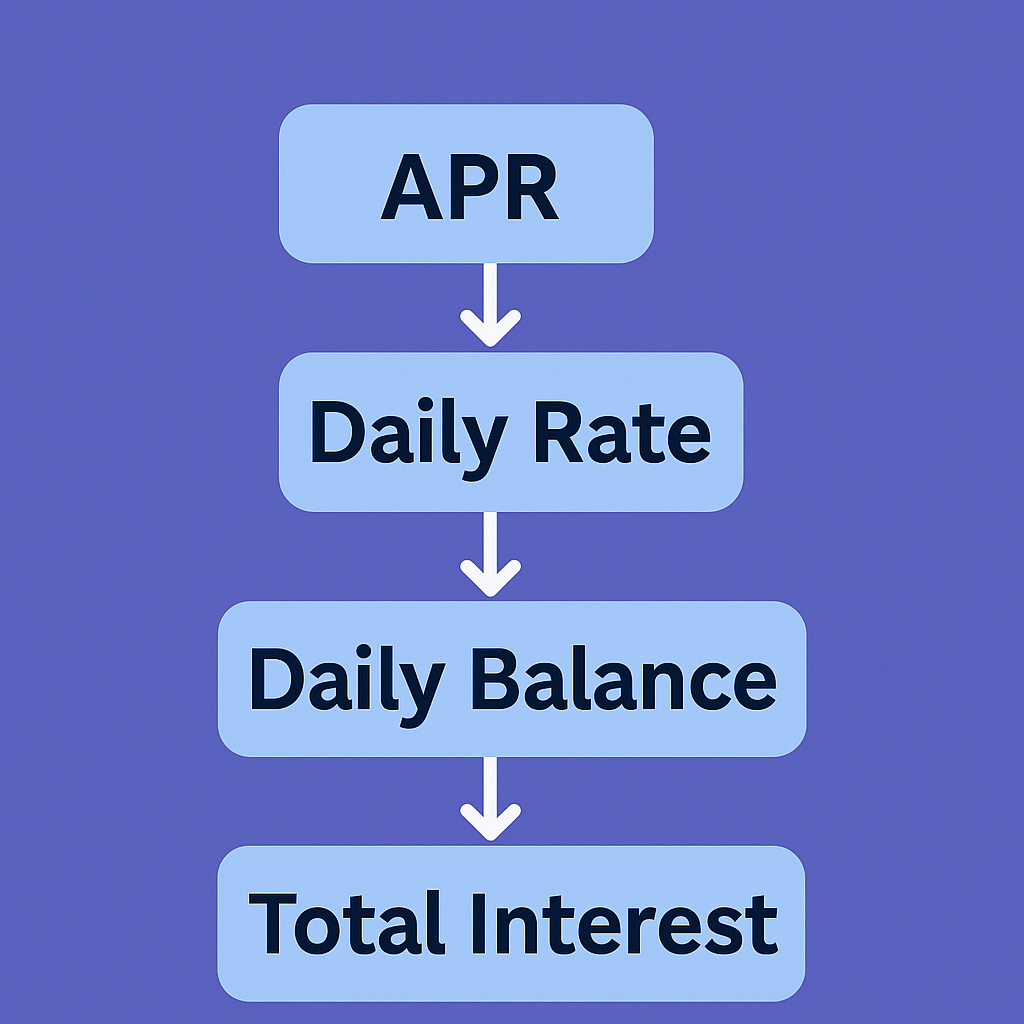

Now, let’s dive into credit card interest calculation. Interest isn’t a flat fee—it’s figured out daily and added up over your billing cycle (usually a month). Here’s how it works, step by step:

- Find the daily periodic rate: Take your APR and divide it by 365 (days in a year). For example, 18% APR ÷ 365 ≈ 0.0493% per day.

- Check your daily balance: This is what you owe each day. It might change if you make payments or new purchases.

- Multiply: Daily rate × daily balance × number of days in the cycle = your interest.

Example Calculation

Let’s say you owe $1,000 with an 18% APR over a 30-day billing cycle:

- Daily rate: 18% ÷ 365 ≈ 0.0493%

- Daily interest: $1,000 × 0.000493 ≈ $0.49

- Total interest: $0.49 × 30 days ≈ $14.70

Here’s a table to break it down:

| Step | Calculation | Result |

|---|---|---|

| APR | 18% | – |

| Daily Periodic Rate | 18% ÷ 365 = 0.0493% | 0.0493% per day |

| Balance | $1,000 | – |

| Days in Cycle | 30 days | – |

| Total Interest | $1,000 × 0.000493 × 30 | $14.70 |

What Is Compound Interest?

What is compound interest? It’s when interest gets added to your balance, and then you pay interest on that new, bigger amount. In the example above, if you don’t pay the $14.70, it’s added to your $1,000. Next month, you’d owe interest on $1,014.70. It’s a small difference at first, but it grows over time.

The average daily balance method is common: they add up your balance each day, divide by the days in the cycle, and apply the daily interest rate. Paying early lowers your average balance, saving you money.

When Interest Is Charged

Interest doesn’t hit you right away. Most cards have a grace period—a window (usually 21–25 days) between the end of your billing cycle and the due date. Pay your full balance during this time, and you avoid interest on purchases.

Interest starts if:

- You don’t pay the full balance by the due date.

- You carry a balance month to month.

- You use cash advances or balance transfers these often have no grace period.

For example, if you owe $200 and pay only $150 by the due date, interest kicks in on the $50 left. Cash advances? Interest starts the second you take the money out, at a higher rate.

How to Avoid Paying Interest on a Credit Card

Good news: you can avoid credit card interest with smart habits. Here’s how:

- Pay in full every month: Clear your entire balance by the due date to skip interest.

- Use the grace period: Pay before the due date to keep borrowing free.

- Skip cash advances: They rack up interest fast with no grace period.

- Set reminders or autopay: Never miss a due date and lose your grace period.

- Look for 0% APR deals: New cards might offer no interest for a while great for big buys.

Paying off your card is like borrowing money for free. Stick to these tips, and you’ll keep interest at zero.

Common Credit Card Mistakes That Cost You Interest

Even smart people make mistakes that add interest. Watch out for these:

- Making only minimum payments: The minimum payments credit card amount keeps your account okay but leaves a big balance. Interest piles up on what’s left.

- Tip: Pay more than the minimum or the full amount to cut interest.

- Paying late: Miss the due date, and you lose the grace period, plus you might get a penalty APR.

- Tip: Use autopay or calendar alerts to pay on time.

- Misunderstanding billing cycles: Think paying early clears everything? You still need to pay the full statement balance by the due date.

- Tip: Check your statement and due date, not just the calendar.

Avoid these traps, and you’ll save cash and stress.

How Your Credit Card Payment is Allocated (Illustrative)

Impact of Payment Strategies on Total Interest Paid Over Time

FAQs

Do I always pay interest with a credit card?

No! Pay your full balance by the due date each month, and you usually avoid interest (thanks to the grace period credit card).

What happens if I pay early?

Paying early helps! It lowers your daily balance, which can reduce if you don’t pay in full. No penalties for paying ahead.

Can I lower my APR?

Sometimes. Call your card company and ask especially if you pay on time or see better offers elsewhere.

How often is credit card interest charged?

It’s calculated daily (using the daily interest rate) but added to your bill monthly.

Pros and Cons of Interest-Based Credit Cards

Credit cards can be great or tricky. Here’s the rundown:

Pros

- Flexibility: Buy now, pay later for emergencies or big items.

- Rewards: Earn points, cash back, or miles on spending.

- Builds credit: Paying on time boosts your credit score.

Cons

- Interest charges: Carry a balance, and costs add up fast.

- Debt risk: Overspending can trap you in a payment cycle.

- Extra fees: Late payments or cash advances cost more.

Use your card wisely pay it off monthly to enjoy the perks without the pain.

Final Thoughts

How does credit card interest work? It’s the fee for borrowing money, based on your APR and calculated daily. Pay your full balance each month to dodge it, thanks to the grace period. Watch out for minimum payments, late fees, and cash advances they’ll cost you. With this guide, you can handle your card like a pro: pay on time, avoid traps, and maybe even snag rewards. Want more tips?

Check out Is American Express a Good Credit Card? Full Review (2025 Guide)